Bear markets usually coincide with deteriorating or poor economic conditions. Three major economic conditions that lead to a bear market are inflation, recession, and rising interest rates. For the Bear market to end, the very first thing the market needs to be able to clearly see that the economy is completely done with the major effects of these three. Next there is usually a time, right at the end, where the market has an extreme drop or “blow off move” as it is sometimes referred to. Once this occurs, then be on the lookout for any number of reversal patterns in the major average stock charts. If all three of these conditions are present, you could be well on your way to the bear market ending.

Table of Contents

Introduction

The economic enemies of the market

Panic Drop

Bottom reversal Pattern

Conclusion

Introduction

The stock market is an anticipatory vehicle. When it anticipates good things, the market becomes greedy and goes up. When it anticipates bad things, the market becomes fearful and goes down. Every possible type of factor is included in the market’s constant assessment of the future. It all gets filtered in and becomes part of the market’s “personality” for that time frame.

As of the writing of this post, we are in the middle of a bear market. This has resulted from the Fed rate hikes which started back in April of 2021. The hikes were necessary to combat inflation which hit a 40 high of and is still persistently staying at high levels. While inflation will persist for some time and the market will continue to struggle, at some point the bear market will end and bring with it some very large profit-making opportunities. The question is how will we know it is over?

The Economic enemies of the market: for the bear market to end, it needs to be able to look into the future and see at least stable economic conditions. The three major enemies of the market from an economic standpoint are Inflation, Recession and Rising Interest Rates. Any one or combination of these three are bad for the market. If the market anticipates any one of these continuing to be a problem, it will not reverse and start a new bull market. Once the economic conditions correct themselves, a new bull market will naturally begin.

Inflation: There are a lot of definitions of inflation, but for our purposes we will just refer to it as a generalized increase in the cost of goods and services. If the inflation rate is higher that the FED’s stated goal level, there will be downward pressure on the markets. Inflation is insidious and eats away at a company’s profitability, so it also effects their customers and leads to lowered revenues. Spiking inflation is often the reason why the fed must raise interest rates. To slow down the rise in prices, the FED will restrict the flow of money into the market by raising interest rates. The FED will continue to raise rates until it believes the unusual spike in inflation is over.

Recession: once the inflationary cycle has ended, a recession or contraction of the economy often occurs. While the market wants to celebrate the win over inflation, it usually is not ready to start a new bull market yet due to the ensuing recession that the elevated interest rates created. Not until the fed starts lowering the rates again to more normal levels with a real bull market begin.

Rising Interest Rates: rising interest rates are the enemy of the market. A large percentage of the time that the FED has raised interest the market went into a correction or Bear Market. A new bull market will not start until the interest rate increases stop and may even wait until the FED starts lowering rates again.

Panic drop: in the past, many bear markets have ended in a very fast, aggressive sell off in the overall market. These moves are sometimes referred to as “blow off” moves. These moves, especially at the end of a long-drawn-out bear market sell off can signal the beginning of a new market environment. These sell offs are in many cases panic selling and represent the final nail in the coffin of “stupid money” leaving the market.

Bottom Reversal Pattern: finally, the general market averages must show some type of bottoming pattern. Here are several more prevalent ones:

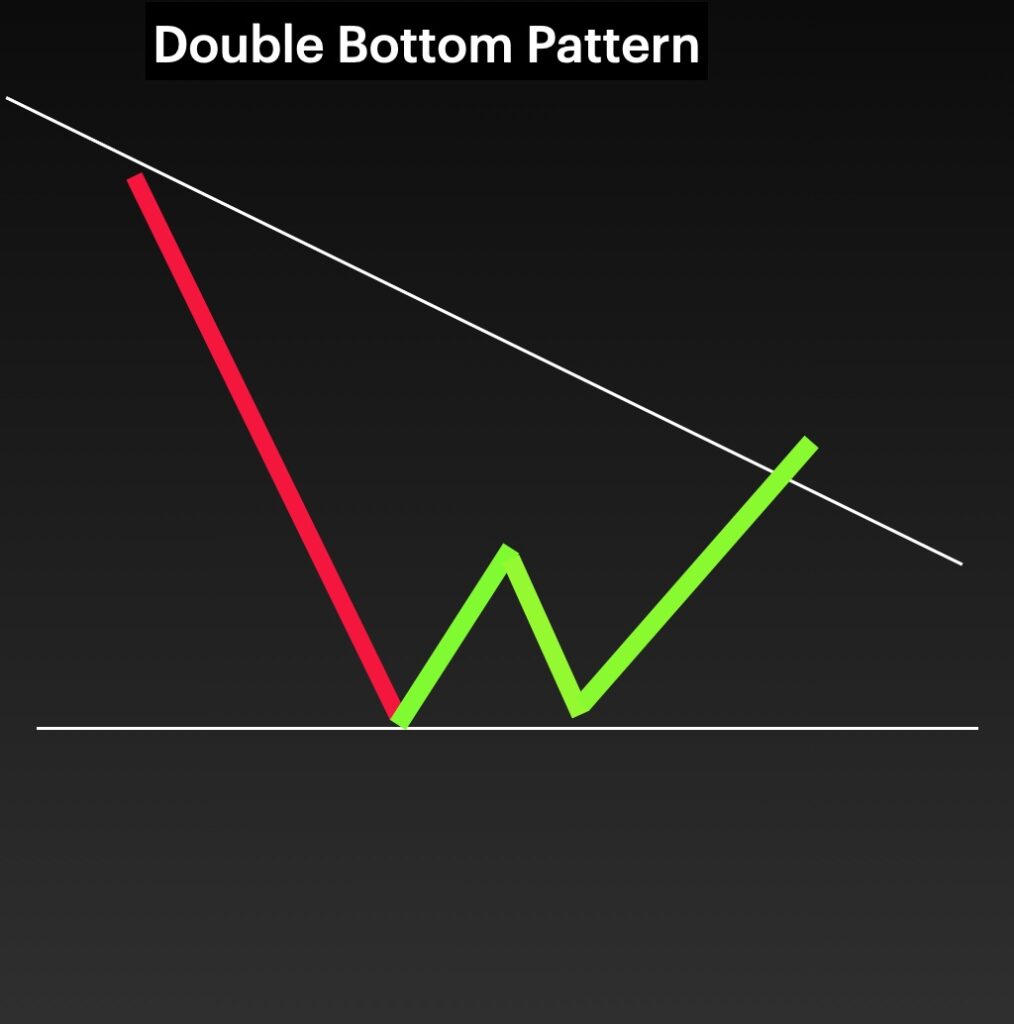

Double Bottom: the double bottom is a chart pattern that looks like a “W” at the bottom of the long-drawn sell off or channel in the market average.

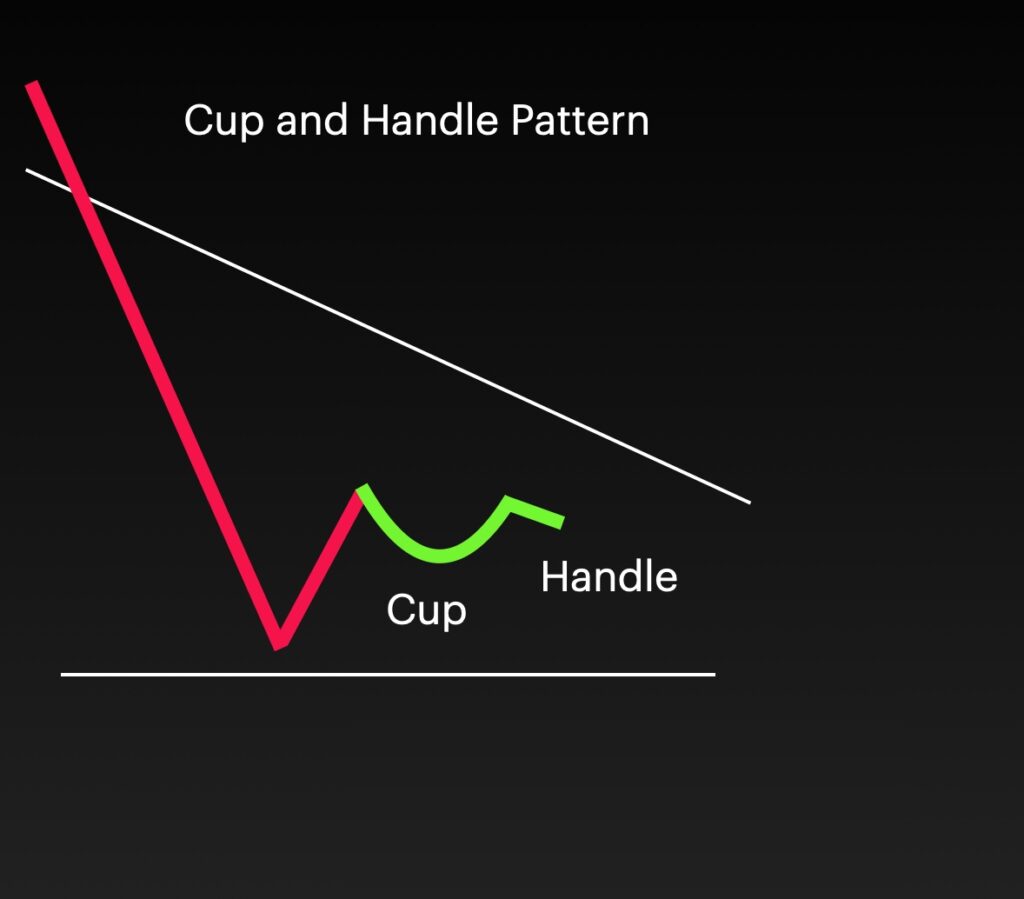

Cup with handle: a cup with handle pattern is a chart pattern that looks just like the name, a cup with a handle. The more the pattern looks like a real teacup the better! In a new bull market, cup with handle patterns is very reliable. If it fails, you can rest assured that the bear market continues.

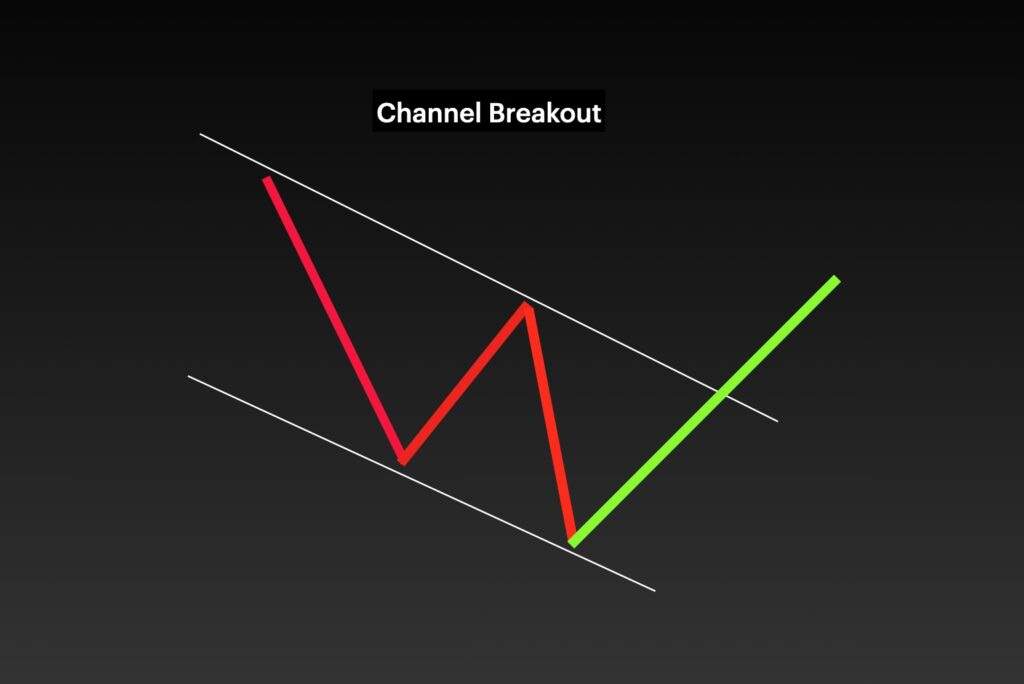

Channel Breakout: a channel breakout is when a market index forms a very orderly downward channel for an extended period and then in conjunction with the other factors discussed, breaks out of the pattern. The index will then start to try to form a new upward channel.

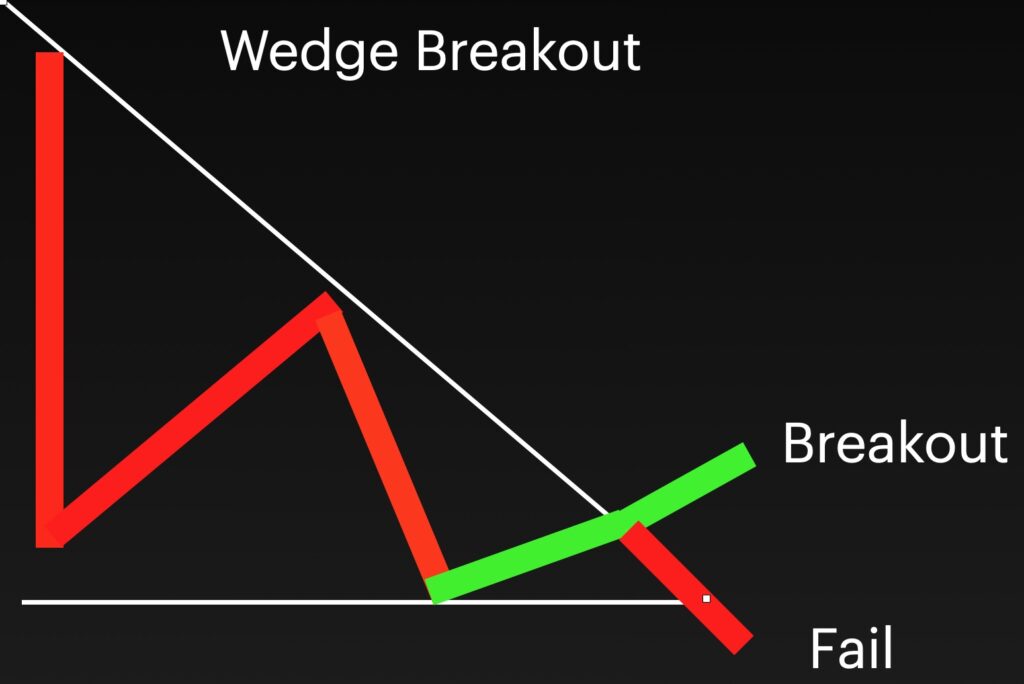

Wedge breakout

A wedge occurs when a channel’s bottom starts to flatten, and the upward swings get smaller and smaller until they “wedge”. When a wedge breaks, it can break up or down. Obviously in a bear market we are looking for a wedge breakout to the upside in the major average or averages. This can be a strong signal that the market has bottomed, and the bear market is over.

Conclusion

In this post we have discussed how you will know if a bear market is over and done with. The three economic enemies of the market are Inflation, Recession and Rising interest rates. While any of these three factors remain, a bear market is most likely to persist. Once these macro-economic factors are cleared then the market can move forward and start to stabilize and then go up. Signs that these are happening are a panicked selling blow off move followed by a bottoming or reversal chart pattern in the major averages. Until that point, don’t fall prey to head fake moves of the market. Stay safe and wait for the bull market to manifest.