By Philip Moskie

Cathie Wood is the CEO and CIO of Ark Investment Management LLC, an investment management firm. She is treated as one of the top Fund Managers receiving many awards including the prestigious Forbes 50 over 50 in 2021. With over $12B under management and 8 different ETF’s, Wood’s focus is on disruption, innovation, and technology. By many measures, she is an extremely successful leader in the financial world. However, the actual results she’s produced in her investments have come up short of expectations.

Table of Contents

Introduction

Ark Investments Performance to Date

What are the Problems

Problem: Bad Market Timing

Problem: Wrong Sectors for Bear Market

Problem: Stock Picker’s Mentality

Methodology vs. Market Reality

What Now?

Conclusion

Introduction

Cathie Wood is a name certainly very well known in the financial world. She has achieved a lot of notoriety and is a frequent commentator on top level financial news shows. She has achieved almost celebrity status. Just like some other top celebrities though, the question is whether she has achieved this status through performance or is it obtained through some type of cult like following stemming from her progressive methodology and perceived sense that it makes. Unfortunately, this makes no difference to investors who are simply looking for the best way to make money.

Let’s be clear here, this is not a post designed to bash Cathie in any way. We do respect her work and what she has achieved in the business world. The purpose of this post is to explore the reason why she has run aground and give you some direction on how you can avoid doing the same yourself in the market.

Ark Investments performance to date

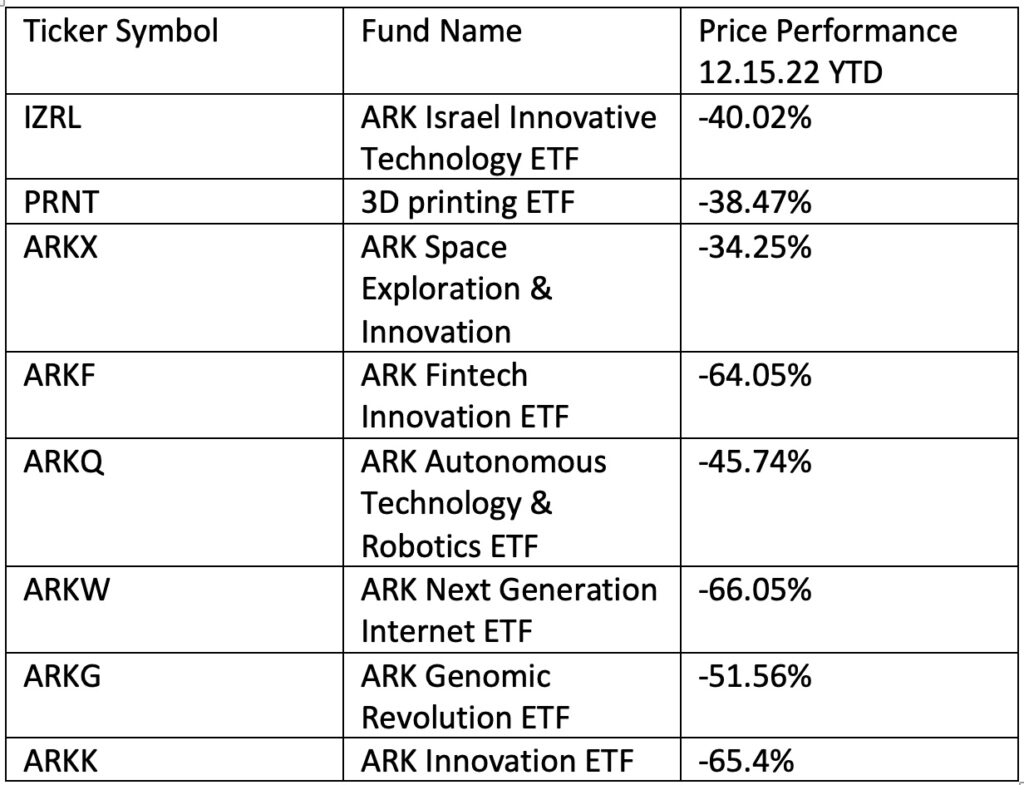

The performance of Cathie Wood’s ETF funds is shown in the table below. As you will note, the performance is less than spectacular.

What are the problems?

As we see it, there are several problems that are the root cause of Cathie Wood’s Ark Investment’s less than stellar performance.

Problem: Bad market timing

When the bear market hit in 2020 many very well-respected hedge fund managers and money managers got caught flat footed. There were many warning signs, but the bull market was so long and so strong that no one really believed a real bear market could be lurking in the wings. Cathie Wood was no exception. As a matter of fact, following her true mission kept her in an even more difficult position than most. She already had stock positions that had performed amazing well for quite some time. Since these stocks fit her mission, she was reluctant to sell them when the market started to decline. She decided to take a ride into the valleys of the bear market not knowing how perilous they could be.

Problem: Wrong market sectors for a bear market

The stated focus of her funds is disruption, innovation, and technology. Her website says:

“We’re all about finding the next big thing. Those hewing to the benchmarks, which are backwards looking, are not about the future. They are about what has worked. We’re all about what is going to work.”

She is trying to predict which companies will not only do well financially, but that will disrupt entire industries. This is a very tall order especially in a time where investors are just trying to survive.

When times get tough, investors flee to what are called “defensive stocks”, and young innovative companies usually land in trouble. Smart money heads to stocks in sectors that traditionally do better in bear markets. Fledgling sectors and companies can drop precipitously and stay there for long periods of time. Some of them may never recover. We only must look back at the dotcom crash in the 1990s to see a clear example of this.

If bear market conditions continue, this flight to safety will also continue and Ark’s investment strategy will underperform.

Problem: The Stock Pickers Mentality

According to Wikipedia, Wood was named the best stock picker of 2020 by Bloomberg News editor-in-chief emeritus Matthew A. Winkler.

While this is obviously nice recognition to get, it highlights a major problem we see with Wood’s stock picking approach to investing. By its very definition, a bear market is when a large percentage of ALL stocks go down in value. If the major market indexes are down 30% then you can rest assured that most stocks are down significantly. Picking stocks based on what the company does and the amount of disruption they may create rather than earnings, revenue and price action is a losing endeavor when fear rules the market.

To make money in a bear market you must think like a trader, not a stock picker. A trader anticipates market moves and time their trades to take maximum advantage of the market swings. They pick stocks that are most likely to “do what they are supposed to do” rather than by what business methodology the company’s founders ascribe to.

You can pick the best company in the world, but if the market enters a real correction, then your stock is going to get hit. Currently Apple, a company that many believe is the best in the world, is more than 20% off its highs. The key though is that while Apple may be down 20%, the Nasdaq is down 30%. This shows that Apple is relatively stronger than the market and it is doing what it is supposed to do, beating the market. Stocks that show this type of “relative strength” will be great stocks for investors with a trading mentality.

These smart investors will wait until the general market has major draw downs and then add to their positions in stocks showing strong relative strength. This allows them to bring their average costs as low as possible. They “fight” the position and trade it until they get profitable. Stock pickers just pick a stock; decide how many shares to buy and then sit back to see what happens.

Methodology vs. Market reality

Cathie believes in buying stocks that sacrifice early revenue to pursue the longer-term disruption of a market. Their website states: “In our view, the companies in which we invest are sacrificing short-term profits to capitalize on the exponential growth and highly profitable opportunities that a number of innovation platforms are creating.”

While we don’t disagree with the concept Cathie is espousing, the problem is that sometimes reality hits you right in the face. As world champion boxer Mike Tyson once said, “everyone has a plan until they get punched in the face.” The same is true in the market. It is awesome to have this grandiose plan to change the entire investment world, but investors expect returns.

What now?

Investors in ARK’s funds need to maintain a long-term perspective. After all, you don’t expect to disrupt entire industries overnight. It is very questionable how loyal investors are going to be when their investments are down 60% or 70% or more. As the bear market drags on, chances are that many are going to have to bail, not because they don’t believe in her mission, but because they must protect themselves. However, we must note that at the time of this writing net flow of cash into her funds continues to grow. Only time will tell. We wish her and her investors good luck.

Key Takeaways

1. If you agree with Cathie Wood and Ark Investments, you must have a long-term perspective and be able lock up the money you invest there for the long term

2. When it comes to making money, the market will beat methodology every time

3. You must develop the mindset of a trader not a stock picker

Conclusion

In today’s article we have explored Cathie Wood’s Ark Capital. We looked at some of her history and then reviewed the results her current ETFs are producing. We then discussed some of the reasons why we believe she is showing such poor results. As we stated earlier in this article, we very much respect and her vision of the future. We do however question if fate, the market, and investors will allow her the opportunity to see it to fruition.