By Philip Moskie

How can you use ChatGPT to help you be a better GARP investor? While it cannot search the web or do calculations, it can help you identify potential GARP investing opportunities through ETFs. The results will only include data up to 2021. This means you will have to continue your research in a more conventional manner.

Introduction

As an investor, you’re always looking for ways to improve your returns and make better investment decisions. One strategy that has proven to be successful over the years is Growth at a Reasonable Price (GARP) investing. GARP is a strategy that focuses on finding companies that have strong growth prospects but are trading at a reasonable price. In this blog post, we’ll explore how you can use ChatGPT, a powerful new tool, to help you identify potential GARP investing opportunities and make better investment decisions.

What is ChatGPT?

OpenAI developed ChatGPT, a large language model. ChatGPT can understand and generate human language because OpenAI trained it on a vast amount of data. Its applications include natural language processing, language translation, and text generation. As for investing, ChatGPT helps you identify potential GARP investment opportunities by analyzing financial data and finding companies that fit the GARP criteria.

What is GARP?

GARP investing is a strategy that focuses on finding companies that have strong growth prospects but are trading at a reasonable price. The idea behind GARP is that you can find companies that have the potential to grow at a faster rate than the market but are still trading at a price that is reasonable relative to their earnings and growth prospects. By investing in these companies, you can potentially earn higher returns than the market while also minimizing your risk.

ChatGPT Limitations and How to Get Around Them

While ChatGPT is a powerful tool, it does have some limitations. For example, it cannot search the web or do calculations. To properly utilize its amazing power, you need to utilize other resources to get updated information on the stocks of interest. Additionally, the results that ChatGPT provides will only include data up to 2021, so you’ll need to continue your research in a more conventional manner.

Step 1: Use ChatGPT to Identify ETFs that may contain potential GARP stocks

The first step in learning how to use ChatGPT to help your GARP investing is to identify ETFs that may contain potential investing candidates. ETFs are a type of investment vehicle that holds a basket of stocks and can be traded like a single stock. ETFs that specialize in GARP investing are a good start. You can also ask ChatGPT to give you ETFs that are value based and others that track stocks with low PE ratios. There are so many different ETFs, so get creative in what categories you ask ChatGPT to generate. Once you’ve identified the ETFs that may contain potential GARP stocks, you can use the internet to get more information on the individual stocks that they contain.

Step 2: Get updated information on stocks in the ETF by using the Internet.

Once you’ve identified the ETFs that use the GARP strategy, you’ll need to use a more conventional approach to get the information you need on the individual stocks that they hold. This will include information such as the current stock price, earnings per share, and revenue growth. You can use websites like Yahoo Finance or Google Finance to get this information.

Step 3: Use ChatGPT to Help Create Your GARP Investment Criteria

Once you have the information on the individual stocks that the ETFs hold, you can use ChatGPT to help you create your investment criteria. This can include things like the P/E ratio, revenue growth, and other financial metrics that are important for GARP investing. You can use ChatGPT to analyze the data and identify companies that fit the GARP criteria.

Step 4: Create a Watchlist of target GARP Stocks

Once you’ve identified the companies that fit the GARP criteria, you can create a watchlist of all those stocks. This will allow you to keep track of the stocks that you’re interested in and monitor their performance over time.

Step 5: Narrow down your GARP choices

Narrow your choices down to a solid group of companies you think are good candidates. Continue to do you due diligence until you are ready to invest.

What we found:

We asked ChatGPT to give us an ETF that tracked with the S&P 500 Growth at a Reasonable Price Index. It is a stock market index created by Standard & Poor’s (S&P) that aims to track the performance of companies in the S&P 500 that have strong growth prospects but are currently undervalued. The index is designed to identify companies that have a combination of growth and value characteristics.

ChatGPT identified SGPG as an ETF which tracks with the S&P 500 GARP index. The fund manager is Invesco. If you click on this link to Invesco’s website, you will see each stock that is in the index. There are about 50 stocks in the SGPG ETF making it a good starting point for your GARP investment research. Keep in mind, this is just one ETF and there are many other options out there. It’s important to continue your research and due diligence to make informed investment decisions.

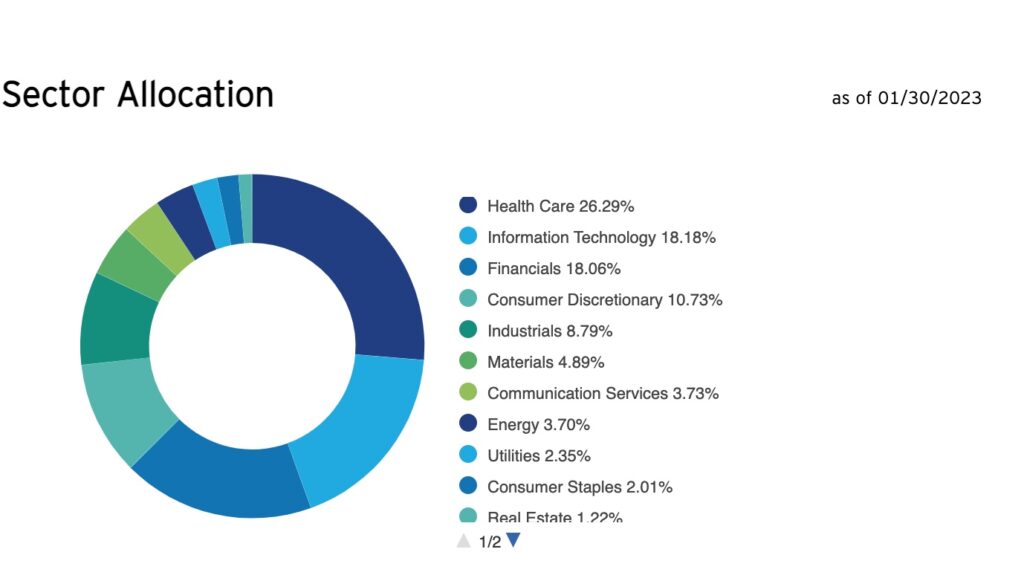

Sectors: Here is a list of the potential industries we found on Invesco’s site page for SGPG:

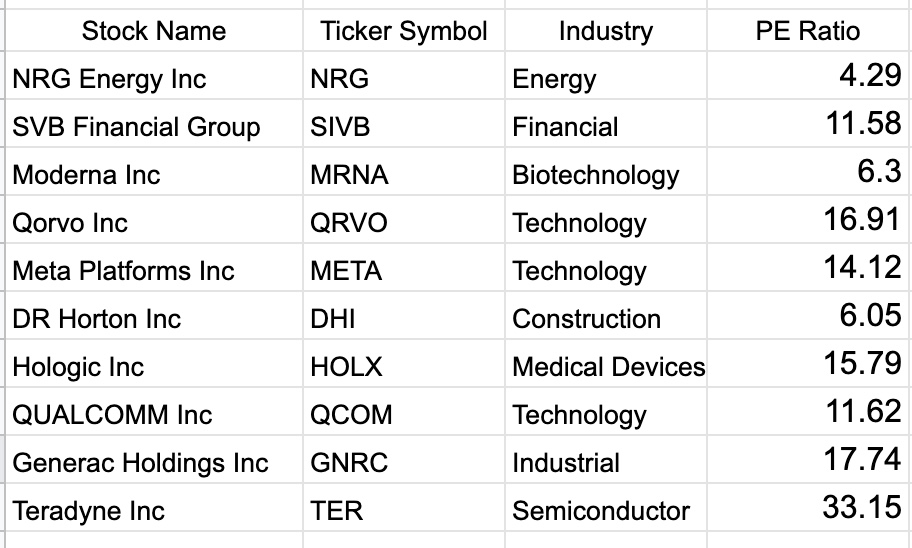

TOP 10 Holdings:

Then we took a list of the top 10 stocks from their site and asked ChatGPT to create a table with these 10 stocks. We then took the table and added it to Google sheets. We asked it to propagate the PE ratio using the following formula: =GOOGLEFINANCE(B3,”pe”). This makes the sheet automatically fill the PE ratio column as time goes on, so you track it.

You can add any additional columns you need for your investing criteria. Use the Google finance function based on the Google’s guidelines at Google Support.

What’s next:

You can then take each company identified and have ChatGPT write up a profile for each. Remember ChatGPT only has data up to 2021. So you will have to do further due diligence, but this is a real good start. Here is an example of what it generated for NRG Energy:

NRG Energy (symbol: NRG) is an American energy company that specializes in producing, distributing, and selling electricity and natural gas to residential, commercial, industrial, and wholesale customers. It was founded in 1989 and is headquartered in Princeton, New Jersey. The company operates a diverse portfolio of power generation assets, including natural gas, coal, nuclear, solar, wind and battery storage facilities, across multiple states in the United States. NRG Energy is a publicly traded company, and its stock is listed on the New York Stock Exchange. The company has faced some financial difficulties in recent years, including declining revenue, increased debt, and low stock prices. However, it has also made efforts to diversify its business and transition to a cleaner energy mix through investments in renewable energy and energy efficiency.

This is just an example of how you can overcome the limitations of ChatGPT and use it to become a better trader. The key here is that you need to identify you own criteria, figure out where that information is and figure out a way to use ChatGPT to access it.

Key Takeaways

- OpenAI developed ChatGPT, a powerful language model that can help you identify potential GARP investment opportunities.

- GARP investing is a strategy that focuses on finding companies with strong growth prospects and a reasonable stock price.

- You will have to continue your research using other resources because ChatGPT only trained on data up to 2021.

- Use ChatGPT for GARP investing, by identifying ETFs that contain potential GARP stocks. Then use the internet to update your information on individual stocks. ChatGPT to analyze the data and create your investment criteria, create a watchlist of target stocks, and narrow down your choices.

Conclusion

In conclusion, ChatGPT can be a useful tool for GARP investing. It can help you identify potential investment opportunities and assist in creating your investment criteria. However, it’s important to keep in mind its limitations and to continue your research to make informed investment decisions. Remember, investing involves risks and it’s important to seek advice from a financial professional before making any investment decisions.