- The three main types of Trading

- Is swing trading good for beginners

- Swing Trading Strategies

- Swing trading tools

- What type of stocks should I swing trade?

One of the most frequent questions I get asked is: “what type of trading is best for beginners?” This is a very good question, and in this post, we will explore the answer to that question. We will examine what the three major trading types are, which of them is the best for beginners and how to start your journey using the type of trading that gives you the best chance of success in this new endeavor.

The Three Main Types of Trading

In our last blog post entitled “How Do Beginners Make Money In The Stock Market?” we briefly discussed the three types of trading available to new traders. To summarize, the three types of trading are 1) Day Trading 2) Swing Trading 3) Long-Term Investing.

Day Trading

Day Trading is the process by of purchasing a stock and selling the position by the end of the trading day. This is by far the most difficult trading to do. The first challenge is that you must stay at your computer screen most of the day to day trade successfully. This means that from 9:30AM until 4PM you must be on your computer watching the market. This eliminates day trading as an option for most busy people.

The second challenge with day trading is that since you must exit your position by the end of the day there is very little room for error. Many day traders lose money because they simply run out of time with the trade and they must close a position at a loss.

Last but not least, to day trade you must have a minimum of $25,000 in your account to day trade. Most people just starting out simply are not in a position to make this type of financial commitment. Beware as some so-called guru’s out there will try to tell you how to “get around” this financial requirement. My advice to you is that anyone advising you how to avoid the law should be avoided at all costs. Follow this link to the FINRA web site to see further details on the pattern day trade requirement.

Swing Trading

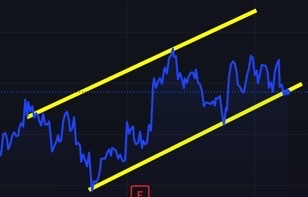

Swing trading is the process of buying and selling stocks for a longer time frame, usually weeks or months. Stocks tend to increase in price or decrease in price in a stair step fashion. When you look at a stock chart these movements tend to swing up and down within a given range or “channel”. Swing trading is the attempt to purchase a stock on the downward swing with the intent of selling it into the upward swing in the price of the stock.

Long Term Trading

Long Term Trading is the process of buying and holding stocks for years or even decades. This type of trading is also referred to as “Value Investing”. It tries to take advantage of the long-term growth of the company the stock represents and also of the long-term appreciation of the stock market.

Most people who decide to start trading are just not suited for this type of trading. First off, the payoff is so far away in the future that many people just can’t stick to it. Second, holding a stock for this length of time exposes you to many market cycles including corrections and bear markets. Most people panic when the market hits a natural down cycle and their stock dramatically corrects in price. Finally, it is very hard for most people to lock up their money for such a long period of time. Once they hit times of need (new car; emergency bill etc.) they tend to start using this money as a safety net thus derailing their long-term trading goals.

Is swing trading good for beginners?

Swing trading is by far the best type of trading if you are a beginner. It gives you the flexibility a novice trader needs to be successful. Here are the top reasons why it works best for beginners:

- Swing trading slows the game down compared to day trading and allows you to make better decisions

- The intermediate time frame of swing trading allows you to make mistakes and gives you enough time to correct them

- It allows for absentee trading, meaning you don’t have to be at your computer all day to execute your trading plan. The use of “limit orders” helps you do this, and we will discuss them in another post soon.

- It allows you to trade with very little money (No $25K rule like day trading)

The swing trade strategy

When asked the question “what is swing trading?” most authoritative sources define swing trading by its characteristics and not what it actually is. They will mention things like the time frame that the stock is held, or the type of gains investors are looking to achieve. While these criteria accurately describe what may happen during a swing trade, it doesn’t define what swing trading is.

Swing trading is a strategy in which you attempt to take advantage of a stock’s natural swings up and down. If you look at a stock chart below you will see that stocks tend to move up and down in what are known as channels (yellow lines). The channel has a top and a bottom and the swing trader attempts to purchase a stock as it swings lower to the bottom of the channel and sell it when it swings back up to the top of the channel. See the image below (courtesy of tradingview.com)

This is where the term swing trading comes from. It is an exact description of a trader trying to take advantage of the “swings” of the stock. When we understand this, we realize that there is only one true swing trade strategy and that is to buy at the bottom (as close to it as we can) swing and then sell at the top of the swing.

Swing Trade Tools

In order to institute a good swing trade strategy, we must utilize certain tools. Fortunately, all of the tools we need are contained in the free service at Tradingview.com. Below is a list of the basic tools you will need and use when starting out:

- Stock charts: the very basis of our ability to understand a stock’s price and movement.

- Drawing tools: so, we can draw lines and other geometric shapes to analyze what a stock is doing

- Trading simulator (Paper Trading)

- Stock watch lists

Please note that this list does not include many other tools that are utilized by traders. Those tools are more advanced and will not help the beginning trader. In fact, using anything but the basics probably will only hurt your trading efforts. These advanced tools include things like oscillators and indicators, moving averages etc. Do not be misled into thinking that there is some magic tool that will make you a great trader. It just doesn’t work that way. Instead focus on becoming a good or even great trader and then these tools may make sense for you.

What type of stocks should I swing trade?

When I teach people to swing trade, I explain to them that there are only two different types of stocks in swing trading. The first are growth stocks and the second are “good trading stocks”. They are two very different types of stocks and understanding the difference between the two is critical to your success. These are not the only types of stocks that exist, but they are the two that are involved in swing trading.

Growth Stocks

Growth stocks are typically younger companies that have small market capitalization. They typically exist in newer growth industries and have shown recent dramatic revenue and earnings per share growth. Due to their small market capitalization, they often have very dramatic movements in price over very short periods of time. They can be very effective stocks to swing trade in strong bull markets, but when the market enters a period of correction, they can be treacherous and very dangerous for beginners to trade.

Good Trading Stocks

Good trading stocks can be utilized to swing trade in almost any market condition. They are best suited for beginners since their movements are smaller and more controlled. They typically will have much larger market capitalization and are usually older more established stocks.

A good trading stock is also one that has some correlation to a major market average or index. This allows us to measure whether or not the stock is performing above or below average compared to the index it relates to. For example, a stock that is component of the Dow Jones Industrial Index would make a good trading stock. They are typically very well capitalized and trade in correlation with the Dow Jones Industrial Average (DJI). The only challenge is that many of the Dow stocks are very expensive and require too much of a capital commitment for the beginner trader to utilize.

It is our job as swing traders to explore the stocks that make up the other major indexes like the S&P 500 (SPX); The Nasdaq (IXIC) and NYSE composite (NYA) for potential good trading stocks. A future blog post will delve deeper into how to do this research for yourself.

Key Takeaways

- Swing Trading is the best type of trading for most beginners

- Swing Trading is the process of buying low and selling high using a stocks natural swings in price

- There are many free tools for the beginner to use to start their trading journey

- The best type of stocks to swing trade with are “good trading stocks” as opposed to growth stocks

Conclusion

In this post we explored the answer to the question: what type of trading is best for beginners? We reviewed the three broad categories of trading (Day; Swing; Long Term) and discussed why swing trading is the best type of trading for beginners. We explored the strategy of swing trading, reviewed the tools that are available for you to use along with types of stocks that are best suited for swing trading.